Google Wallet has launched in Colombia, enabling users to store and use their credit and debit cards, boarding passes, tickets and other digital credentials on their Android NFC smartphone, Wear OS smartwatch or Fitbit device... More

Google Wallet has launched in Colombia, enabling users to store and use their credit and debit cards, boarding passes, tickets and other digital credentials on their Android NFC smartphone, Wear OS smartwatch or Fitbit device... More

The Clipper fare payment system in the San Francisco Bay Area of the USA is to enable passengers to make contactless fare payments with their physical or digital debit or credit card, Bay Area Rapid Transit (BART) has announced... More

Toronto Transit Commission (TTC) in Canada has added support for open loop contactless fare payments, enabling passengers travelling on streetcars, buses and Wheel-Trans para-transit vehicles in the city to pay fares with a tap of their physical or digital credit or debit card... More

Merchants in the Netherlands can now use their Apple iPhone to accept contactless payments without needing any additional hardware... More

More than £650,000 (US$828,320) of charitable donations have been made to 44 church parishes across The Catholic Diocese of Arundel and Brighton in the UK using contactless cards since the diocese introduced contactless giving terminals in 2019... More

South Korea’s Seoul Metro is to test a ‘tagless’ fare payment system that will enable passengers to pay for their tickets by walking through a ticketing gate without having to tap a contactless reader with their transit card or smartphone... More

The European Parliament has approved a new set of rules governing electric vehicle (EV) charging and hydrogen fuelling stations that requires service providers to enable drivers of alternative fuel vehicles to make contactless payments with a card or mobile device without needing a subscription when charging or refuelling... More

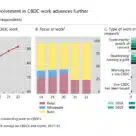

The Central Bank of Nigeria (CBN) is enabling consumers and merchants to use their smartphone to make and receive contactless in-store and P2P payments with the country’s eNaira central bank digital currency (CBDC) using NFC, even if they are offline, according to local media reports... More

Passengers on New York’s subway and bus services have now tapped their contactless bank or transit card, smartphone or wearable device to pay fares using the Omny open loop fare payment system more than 1bn times since it launched in May 2019, the Metropolitan Transportation Authority (MTA) reports... More

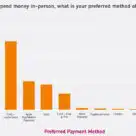

One in five UK consumers (20%) prefers using mobile payment services such as Apple Pay over cash (17%) or chip & PIN card payments (10%) for in-store purchases, a survey has revealed... More

Apple Pay has launched in Morocco with support for debit and credit cards issued by Crédit Immobilier et Hôtelier (CIH) and Groupe Crédit Agricole du Maroc banks... More

Merchants in Brazil will soon be able to accept contactless payments on their Apple iPhone without needing any additional hardware or accessories... More

Apple users travelling on public transport services operated by Transport for NSW in the Australian state of New South Wales can now make contactless payments for their journeys with their iPhone or Apple Watch without needing to unlock their device... More

One in four central banks are now piloting a retail central bank digital currency (CBDC) that consumers would be able to use to make payments, a survey of central banks around the world conducted by the Bank for International Settlements (BIS) has found... More

Merchants in the UK can now use their Apple iPhone to accept contactless payments, with no additional hardware required, Apple has announced... More

Chinese banks have joined a government initiative to add support for payments made using China’s central bank digital currency (CBDC) to physical state-issued social security cards, according to local media reports... More

A new concept dubbed the ‘Instant Payment Card’ could hold the answer to successfully introducing a pan-European instant payments system, Alain Martin, president of the Smart Payment Association, explains in a new presentation for NFCW’s Contactless World Congress online events series... More

“We believe that the digital euro is the natural and digital evolution of our currency,” Evelien Witlox, the programme director in charge of the European Central Bank’s digital euro project, reports in a presentation for NFCW’s Contactless World Congress online event series which is now available to view in the NFCW Knowledge Centre... More

The Central Bank of Somalia (CBS) has unveiled the Somali Quick Response Code (SOMQR), a new EMVCo-based mobile payments standard “that will guide how payment service providers regulated by CBS will issue Quick Response (QR) Codes to merchants and consumers in the country”... More

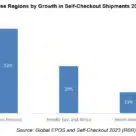

More than a quarter of the 193,000 self-checkout systems shipped to merchants around the world in 2022 were installed in non-grocery stores “as the technology penetrates new segments”, research firm RBR has found. ... More