Nine in 10 consumers in the Asia Pacific region have used mobile payment apps at least once during the past 12 months, while more than half have used digital payment methods at least once a week and a sixth have made a digital payment for the first time since the beginning of the Covid-19 pandemic (15%), according to research published by Kaspersky.

Of those regularly using digital payment methods, 58% have used mobile payment apps, 53% mobile banking apps, 36% debit cards, 33% credit cards and 31% internet banking via browser at least once a week.

The majority of consumers participating in the research identify convenience (81%) as the main benefit offered by digital payments, followed by ease of access (46%) and privacy (39%).

Mobile-first

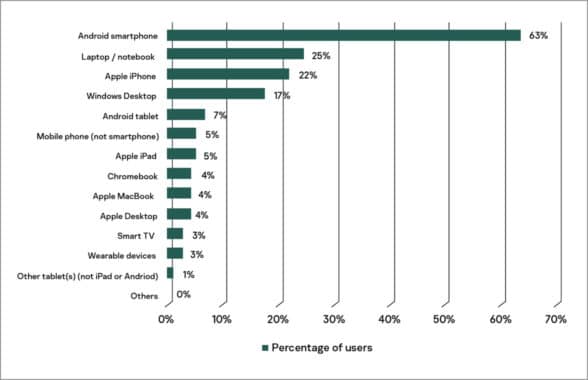

“When it comes to digital payments, a mobile-first approach appears to be dominating the way in which people transact, with 63% of users making payments on Android smartphones, followed by laptops at only 25%,” the researchers say.

These figures compare with 22% of respondents using an iPhone to make digital payments, 17% using a Windows desktop, 7% an Android tablet, 5% an Apple iPad and 3% a wearable device.

In terms of specific use cases, the research found that the percentage of digital payments made from a mobile device was highest for ecommerce sites (72%), money transfers to friends and family (69%), official payments such as utility bills (64%), ride-hailing and food delivery apps (53%) and physical stores (49%), followed by independent online sellers (39%) and donations or fundraising (22%).

New adopters

The report also focuses on the reasons why the 15% of respondents who only started using digital payments during the Covid-19 pandemic had not done so before, finding that “48% of them expressed concerns with losing their money online, with 41% afraid of storing their financial data online, and 35% not trusting the security of digital payment methods”.

When asked what had prompted them to adopt digital payment methods during the pandemic, more than half of these respondents found digital payments to be safer and more convenient than making a physical transaction, especially during the pandemic (55%), with 45% saying they allowed payments to be made while adhering to social distancing, 36% saying it was the only way they could make payments during lockdown, 29% saying digital payments are more secure now than before the Covid-19 pandemic, and 29% saying that being offered incentives and rewards had been a factor.

Business benefits

“Apart from the obvious benefits to customers, those surveyed in our report also felt that digital payment methods such as mobile wallets can offer a positive boost for businesses (59%), with a similar percentage holding the view that small and medium businesses (SMEs) should start using digital payments,” the researchers say.

“However, a significant quarter also felt that the infrastructure (eg internet, lack of device support etc) was somewhat lacking in their country.”

The Mapping a Secure Path for the Future of Digital Payments study is based on a survey of 1,618 adult consumers across Australia, China, India, Indonesia, Malaysia, Philippines, Singapore, South Korea, Thailand and Vietnam conducted by YouGov in July 2021.

Next: Visit the NFCW Expo to find new suppliers and solutions