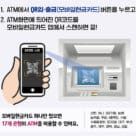

Korean banks let consumers make ATM cash withdrawals and deposits with their smartphones using QR codes

Consumers in Korea can now make cash withdrawals and deposits at ATMs by scanning a QR code with their Apple or Android smartphone rather than needing to use a physical bank card... More