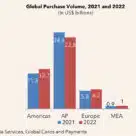

Global purchase volumes hit US$42.7tn in 2022 as payment card spending worldwide increases by 1%

Total card purchase volume worldwide reached US$42.7tn in 2022 with global credit card volumes increasing by 7% and prepaid card volumes by 9%, according to research from RBR... More