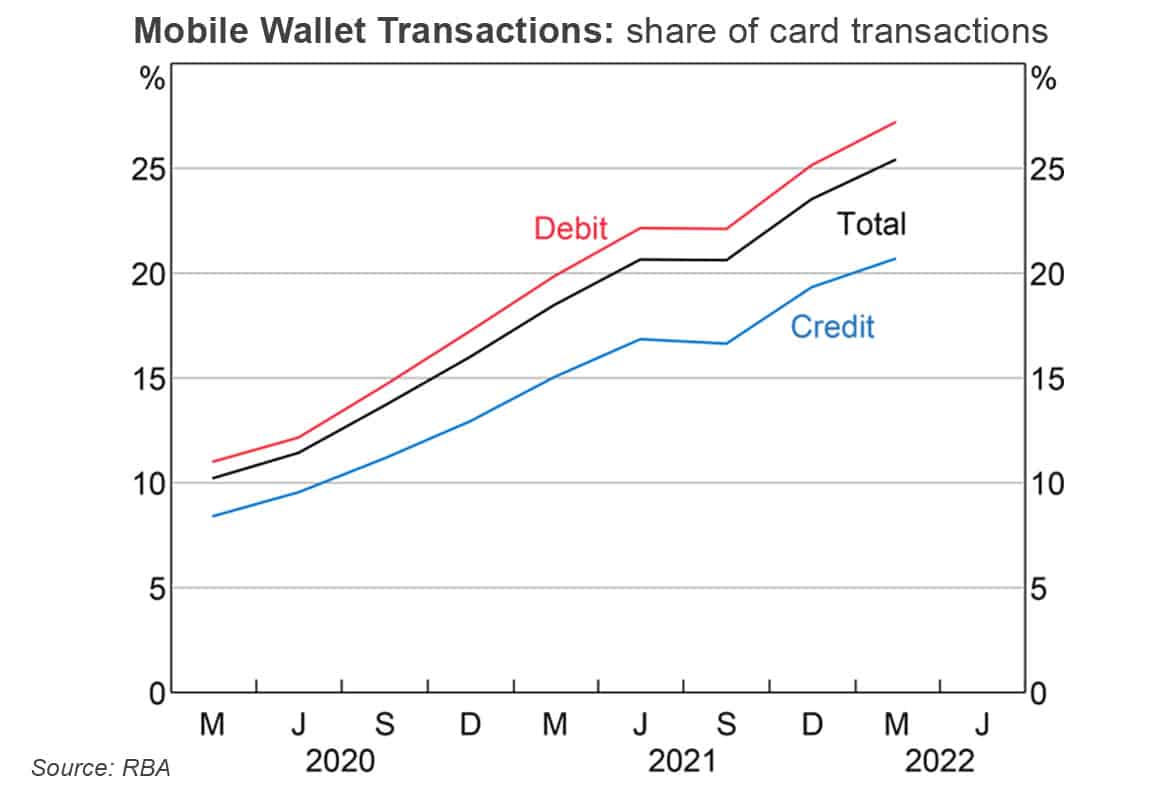

A quarter of all debit and credit card transactions made in Australia are now made using a mobile wallet (25%), up from 10% in the March quarter of 2020, according to figures from the Reserve Bank of Australia (RBA).

The figures also show that mobile wallet payments made with a debit card now account for 27% of all card payments by volume compared with 21% for mobile credit card transactions.

Overall, the majority of transactions in Australia are now made using electronic payment methods such as physical and digital credit and debit cards and account-to-account transactions via the country’s New Payments Platform, and consumers made an average of 650 electronic payments per year in 2021/2022 compared with “about 300 a decade earlier”, the bank reports.

“The use of cash for day-to-day payments has been declining for many years,” the RBA adds.

“This trend accelerated during the pandemic as consumers and businesses preferred to use electronic payment methods for in-person transactions — particularly contactless cards and mobile wallets — and more transactions were conducted online, where cash is not an option.

“For some consumers, this shift is likely to be enduring. For example, in a recent survey commissioned by the Bank, around a quarter of respondents reported that their reduction in transactional use of cash over the pandemic was likely to be permanent.”

Next: Visit the NFCW Expo to find new suppliers and solutions