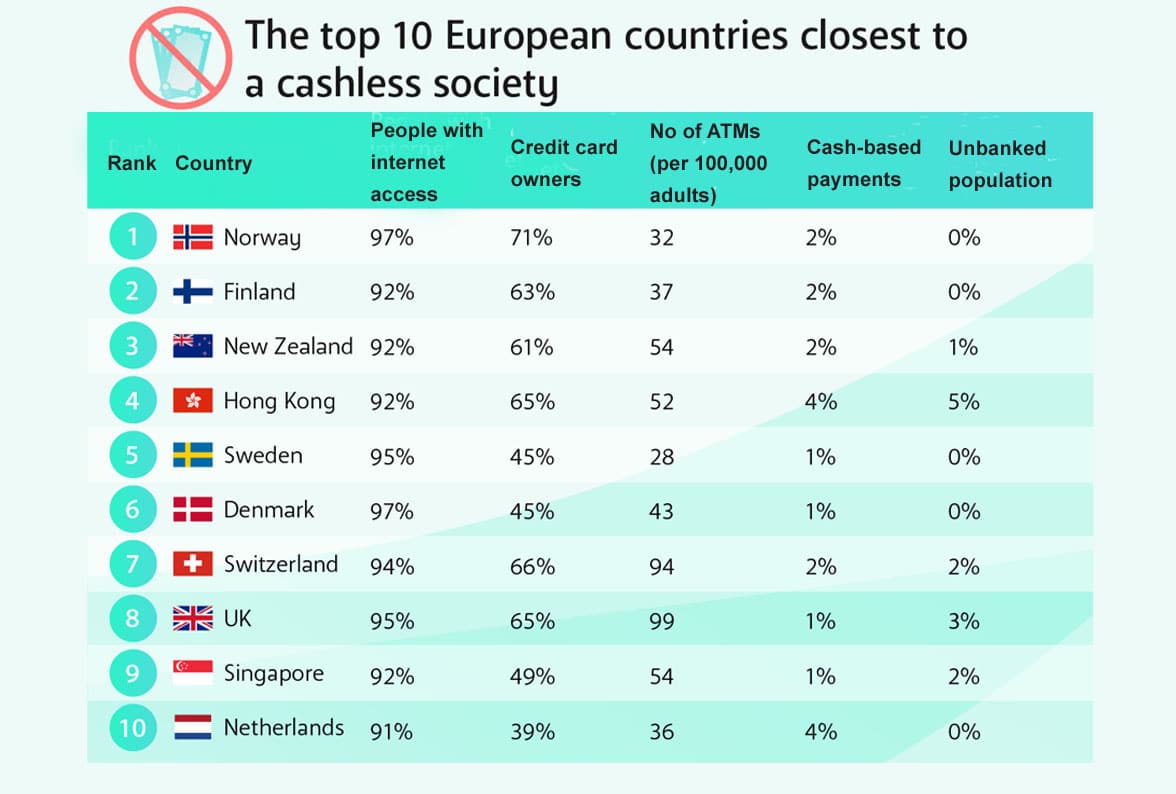

Norway, Finland and New Zealand are the three countries closest to becoming cashless societies, followed by Hong Kong, Sweden, Denmark, Switzerland, the UK, Singapore and the Netherlands, according to research published by Merchant Machine.

The research identifies the increased popularity of digital wallets as “likely contributing to reduced cash use” and shows that Alipay is currently the most popular digital wallet globally with 1.3 billion users followed by WeChat Pay (900 million), Apple Pay (507 million), Google Pay (421 million), PayPal (377 million), Paytm (333 million), PhonePe (300 million), Samsung Pay (140 million), Venmo (52 million) and Cash App (36 million).

Close to cashless

In all 10 countries listed as being closest to becoming cashless the proportion of cash-based payments is now less than 5%, with Sweden, Denmark, the UK and Singapore having the lowest proportion (1%), followed by Norway, Finland, New Zealand and Switzerland (2%) and Hong Kong and the Netherlands (4%).

The research, however, lists countries according to an overall “cash reliant index score” that also takes into account the percentages of people with access to the internet, of people with a credit card, of people who remain unbanked and the number of ATMs per 100,000 adults.

Based on this combination of factors, Norway has the lowest cash reliant index score (1.54), followed by Finland (1.87), New Zealand (2.06), Hong Kong and Sweden (2.10), Denmark (2.15), Switzerland (2.21), the UK (2.22), Singapore (2.32) and the Netherlands (2.46).

By contrast, the figures show that Morocco — where 74% of all payments remain cash-based and 71% of the population are unbanked — is the most cash-reliant country with an overall score of 6.96 followed by Egypt (6.71), Kenya (6.56), Nigeria (6.54), the Philippines (6.42), Bulgaria (6.38), Peru (6.04), Vietnam (6.03), Indonesia (5.88) and Kazakhstan (5.59).

In Europe, the countries with the highest cash-reliant index score after Bulgaria are Romania (6.51), Greece (6.42), Ukraine (6.26), Portugal (5.80), Czech Republic (5.51), Hungary (5.16), Slovakia (4.85), Poland (4.75) and Italy (4.74).

“Bulgaria is the most cash-reliant country in Europe, making 74% of all payments in cash and offering 91 ATMs per 100,000 adults, despite over 70% of the population having a bank account,” the researchers say.

“Despite this heavy cash use, only 28% of Bulgaria’s population are unbanked, meaning a fair number of account holders must still be using cash to make at least some of their payments.”

UK focus

The research also focuses on the UK and shows that card payments make up more than half of all transactions (51%) followed by those made with a digital wallet (32%) with the remainder made by cash (1%), bank transfer (7%) and “other” including buy now, pay later (BNPL) (9%).

“BNPL currently makes up 6.8% of the UK market share of ecommerce payments and is forecasted to reach almost 10% by 2025,” the researchers say.

“Sweden, Germany and Norway are the leading countries when it comes to BNPL, which makes up over 20% of the market share of ecommerce payments in all three countries.”

“The decline in cash-based transactions in the UK has been accompanied by a decrease in the number of ATMs available for cash withdrawals, with more and more being closed,” the researchers add.

“2020 unsurprisingly saw the biggest decrease in total cash withdrawals in the UK at -39.5%, with a further decrease of -5.7% in 2021.

“In the light of the continuing decline in cash payments and ATM numbers in the UK, it seems 2022 is likely to see another decrease in cash withdrawals.”

Next: Visit the NFCW Expo to find new suppliers and solutions