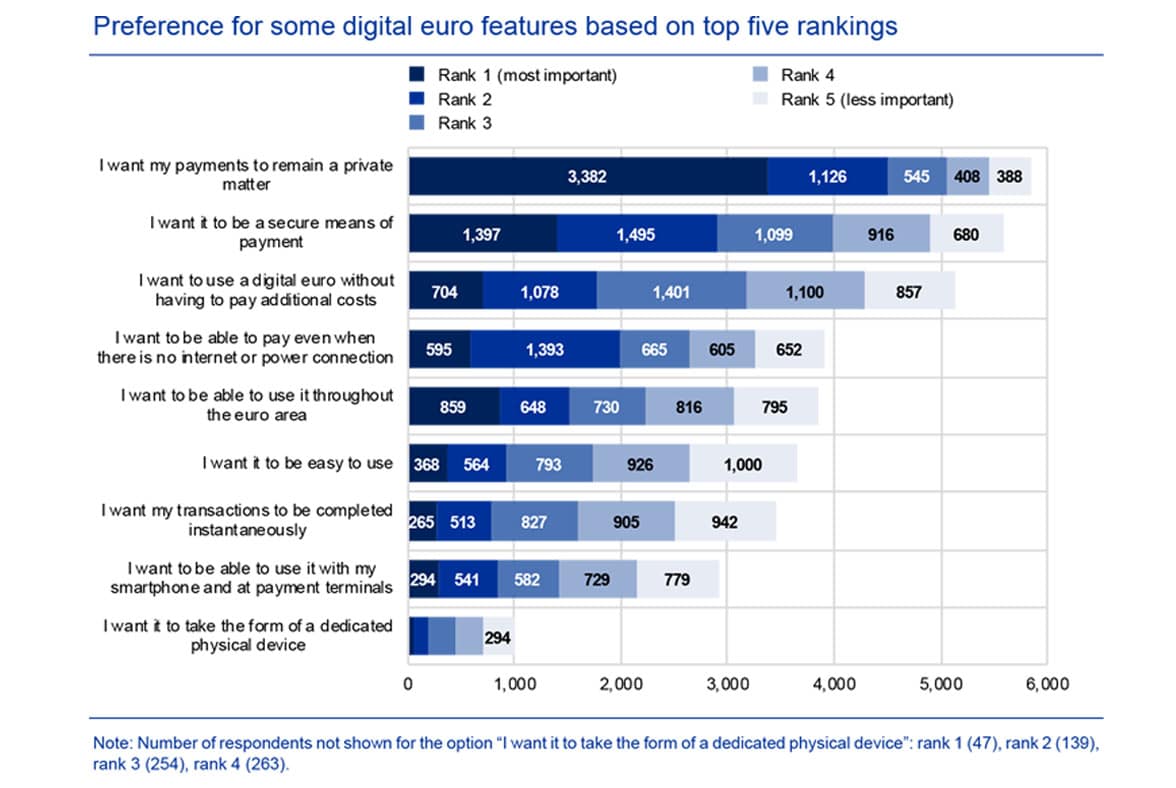

More than two-fifths (43%) of Europeans rank privacy as the most important feature of a digital euro central bank digital currency (CBDC), with 18% citing security, 11% the ability to pay across the eurozone, 9% the lack of additional costs and 8% offline usability, according to a European Central Bank (ECB) survey.

The survey is the result of a three-month online public consultation on the possible introduction of a European CBDC, and also shows that more than two-thirds of respondents believe that “licensed intermediaries should play a role in the provision of digital euro services” and “would be best suited to provide innovative and efficient services, integrating them into existing banking and payment systems”.

“Around a quarter of respondents take the view that a digital euro should make cross-border payments faster and cheaper,” the ECB adds.

“They want the digital euro to be usable outside the euro area, though with limits.”

The consultation additionally asked for views on the technical implementation of a digital euro with a quarter of individual respondents saying that “end-user solutions comprising (smart) cards or a secure element in smartphones would be preferred to facilitate cash-like features.

“Almost half mention a need for holding limits, tiered remuneration, or a combination of the two, to manage the amount of digital euro in circulation. A similar share of professional respondents agree.”

More than 8,200 private citizens and professionals from banks, payment service providers, merchants and technology providers took part in the consultation.

The ECB launched the consultation in October 2020 and is due to make a decision on whether to launch a digital euro project “in mid-2021”.

Next: Visit the NFCW Expo to find new suppliers and solutions