European Central Bank sets out business model for digital euro

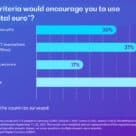

Payment service providers will be able to charge merchants a fee for enabling them to accept digital euro transactions, the European Central Bank (ECB) has revealed, but a cap will be placed on the amount that it will be possible for them to charge... More