Apple Pay coming to Miami fare system in August — Appleosophy — “Miami-Dade County’s fare system for their transit is set to begin accepting Apple Pay and other forms of contactless payment systems, such as Google Pay and Samsung Pay. According to an image found on Reddit, it would appear as though the Miami-Dade County transit system is set to begin accepting Apple Pay in August 2019.”

- Bank of China lets taxi drivers accept central bank digital currency payments on NFC mobile phones

- Juniper forecasts 25% increase in POS terminal transaction values by 2028

- STMicroelectronics launches NFC tag chip with elliptic curve cryptography

- NFC Forum survey finds majority of consumers now prefer making payments with their mobile phone

- Hello, NFCW readers!

Metrolink rolls out open loop ticketing on Manchester trams

Passengers set to benefit from new contactless payments on Metrolink — Transport for Greater Manchester — “The new system will mean customers can simply touch-in at the start of a journey and touch-out at the end using a contactless bank card or another contactless-enabled payment device, such as a phone or watch. The system will then automatically work out the total daily fare for a customer’s journeys and the price will be capped — to ensure they are paying no more than the relevant adult daily one-day travelcard price.”

Shinhan to put credit cards on the blockchain

Shinhan Card develops blockchain-based payment system — The Korea Times — “With the patent-winning technology, the card firm has established a blockchain-powered credit transaction process that enables various functions, such as setting a maximum spending limit, paying in monthly installments and completing payments between merchants and consumers… The company is the first in the world to have established a credit transaction service using the new record-keeping technology, it said.”

Turkey unveils plans for a central bank-issued digital currency

Turkey puts central bank digital currency on new economic roadmap — Coin Telegraph — “The government of Turkey has included a central bank-issued digital currency in its 2019–2023 economic roadmap published on July 9… In addition to a central bank digital currency, the development plan lists blockchain adoption in the operations of transportation and customs.”

Samsung partners with Korean banks and carriers to launch blockchain mobile ID platform

Consortium launches blockchain-based digital ID in S Korea — Yonhap News — “A group of major tech companies and financial institutions have joined hands to launch a blockchain-based digital identity platform available on smartphones… Samsung Electronics Co, three mobile carriers — SK Telecom Co, KT Corp and LG Uplus Corp — KEB Hana Bank, Woori Bank and Koscom, an IT subsidiary of the main stock exchange, signed an agreement to jointly develop a mobile application for the digital ID platform.”

Keep up to date: Get NFCW's headlines by email every Wednesday

Libra to use QR codes to let consumers buy and sell cryptocurrency

Facebook answers how Libra taxes and anti-fraud will work — Techcrunch — “Facebook is also in talks with local convenience stores and money exchanges to ensure anti-laundering checks are applied when people cash-in or cash-out Libra for traditional currency, and to let you use a QR code to buy or sell Libra in person.”

Amazon rolls out QR-based anti-counterfeiting platform

Amazon launches Transparency in Europe, India and Canada — Amazon — “Transparency is a product serialisation service that provides a unique code for every unit that is manufactured. Brands put these codes on its products and every time one of these products is ordered in Amazon’s stores, Amazon scans and verifies the code to ensure only authentic units reach customers. Additionally, customers can use a mobile app to scan the code and verify authenticity regardless of where they purchased their units. Brands can also use Transparency to communicate unique unit-level information, including manufacturing date, manufacturing place, or other enhanced product information (eg ingredients).”

Hong Kong commuters to get iPhone and Apple Watch ticketing ‘later this year’

Octopus coming soon to iPhone and Apple Watch — Octopus — “Octopus Cards Limited is excited to announce that customers will be able to use their Octopus on their iPhone or Apple Watch for transit and retail payment with Apple Pay later this year. More details will be shared soon.”

Apple Pay offers free fries at McDonald’s

Latest Apple Pay promotion offers free fries at McDonald’s all month — 9to5Mac — “Apple today has kicked off its latest Apple Pay promotion. This time, users can secure a free order of french fries from McDonald’s when using Apple Pay all month long… Apple has been offering Apple Pay discounts through various retailers, services, and restaurants on a near-weekly basis recently. Recent offers have included US$1 tacos through Taco Bell, US$5 off select Fandango movie ticket purchases, and more.”

Merchant payments association calls for 18 month delay on strong customer authentication

EPSM recommends harmonised migration plans on PSD2-SCA — EPSM — “To avoid significant acceptance disruptions, EPSM recommends that all regions should agree an additional timeframe of 18 months for standard applications, as well as up to 36 months for challenging applications, such as those in the travel and hospitality sector. This will deliver an EU-wide harmonised migration approach by the EBA and the 28 national regulators for remote card payments.”

Qualcomm to include NFC in entry-level smartphone platform

New Qualcomm 215 Mobile Platform raises the bar for mass market devices — Qualcomm — “The Qualcomm 215 Mobile Platform debuts the following ‘firsts’ in the 2-series: 64-bit CPU, Dual-ISP, supports up to 13MP photo capture, support for Full HD (1080p) video capture, support for HD+ resolution display, hexagon DSP for audio and sensor processing, support for Dual SIM with Dual VoLTE, EVS voice calls, Wi-Fi 802.11ac, support for NFC payments on Android.”

Transport for NSW eyes face recognition for frictionless transit card payments

NSW looks to facial recognition as Opal card alternative — iTnews — “In the transport space we’ll use facial recognition technology to scan customers who’ve ‘opted in’ and linked their Opal account… No more gate barriers – just a smooth journey.”

Keep up to date: Get NFCW's headlines by email every Wednesday

Samsung Pay adds in-app loan and credit card applications in India

Samsung partners with Paisabazaar.com to offer financial products on Samsung Pay — Paisabazaar — “Paisabazaar.com, India’s largest online marketplace for financial products, today announced its partnership with Samsung… Samsung Pay users can apply for credit cards and personal loans from the platform. The move will enable millions of existing and potential Samsung Pay users to get the benefit of seamlessly opting for a host of financial services.”

LG to launch ThinQ mobile wallet in the US?

LG applies for ‘ThinQ Wallet’ crypto wallet trademark in the US — Coin Telegraph — “According to the filing documents, the trademark is for services concerning transaction and settlement services, mobile banking, ‘issuance of cyber money’, and ‘payment application software for mobile phones’ among others. ThinQ is a brand first used for a smart refrigerator introduced by the company in 2011 at a consumer electronics show. Since then, multiple smartphones have been launched under the ThinQ brand.”

Federal Reserve reports on synthetic identity payments fraud

Federal Reserve System white paper examines the effects of synthetic identity payments fraud — FedPayments Improvement — “A synthetic identity is created by using a combination of real information (such as a legitimate Social Security number) with fictional information (which can include a made-up name, address or date of birth)… Over time, fraudsters build up the creditworthiness of the synthetic identity, then ‘bust out’ by purchasing high-value goods and services on credit and disappearing.”

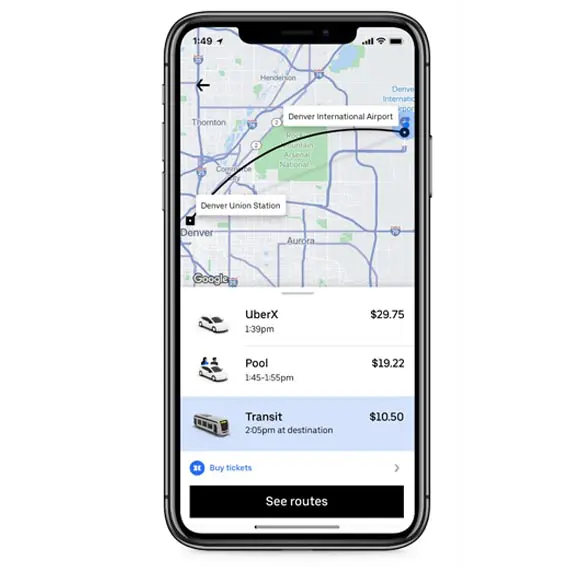

Uber reports on adoption of in-app transit ticketing in Denver

Uber’s move into transit ticketing has resulted in a “strong initial performance” with more than 1,200 Regional Transportation District (RTD) tickets sold through the Uber app since the service launched in Denver in May and growth “averaging 42% each week during the rollout period”... More

Survey: Security tops convenience for UK online payments

Brits care more about online payment security than convenience — Equifax — “Two thirds (66%) of people rate safe and secure payments as most important in the online checkout process, with only one in ten being most concerned about speed or simplicity. Security ranked highest across all age groups, and was a particular concern for over 55s (75%) compared to just over half of 18-24 and 25-34 year olds (52% and 53% respectively).”

Ghana to roll out national QR payments platform

Ghana to launch Universal QR Code for payments this year — Republic of Ghana — “This year, there’s going to be also a remarkable introduction into Ghana of a universal QR Code for payments. This will help us move further into the cashless direction because there will be no longer any need for merchants to have point of sales devices with the QR Code platform. All they need is a mobile phone and even a ‘yam phone’ [feature phone] will work.”

Domino’s pilots cashless stores in Australia

Domino’s Is starting to ditch cash payments — Gizmodo Australia — “The pizza maker is calling it ‘Tap & Take’ and is positioning it as a way to make the ordering process both quicker and more convenient… Domino’s has stated that the participating stores will accept ‘all forms of payment’, except for cash. This includes card payments, PayPal, Apple Pay, Android Pay, EFTPOS to door and Instagift.”

Juniper forecasts rapid growth in mobile-first digital government IDs

Digital ID platforms to be used by 5bn people in 2024, as emerging economies go mobile-first — Juniper Research — “The number of people using government-issued digital identity credentials will grow by over 150% from an expected 1.7bn in 2019 to over 5bn in 2024… Mobile ID schemes take the lead over digital identity cards, with a third more users relying on apps compared to cards in the next five years.”