German savings banks in the Sparkasse group have launched a buy now pay later service in their mobile payments app, enabling customers to request a loan to pay for goods at the point of sale via their Android smartphone and arrange to repay it in instalments.

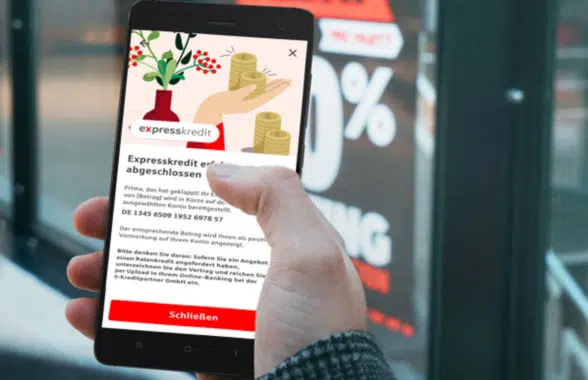

Customers can apply for a loan of between €500 (US$580) and €3,000 (US$3,476) within the banks’ app and, once the application has been approved, “the amount is reserved in the linked checking account in a few minutes and the customer can immediately dispose of the money at the point of sale,” Sparkasse says.

“The express loan is repaid either as part of an instalment loan or after 30 days from the current account.

“The customer can also request the instalment loan directly in the app during the application process for the express loan and then conclude it in their online banking via the electronic mailbox.”

“It is the first step in expanding the mobile payment app into a comprehensive payment platform,” Sparkasse adds.

“Bundled in just one app, the savings banks will in future be able to offer added value and additional services that go far beyond paying.”

Sparkasse launched a software POS service that allows merchants to accept PIN-free contactless payments on their Android NFC smartphone in April.

Next: Visit the NFCW Expo to find new suppliers and solutions