More than 488,000 consumers in Nigeria have downloaded an eNaira digital wallet and conducted transactions worth a total of 62m naira (US$151,000) in the country’s central bank digital currency (CBDC) since its launch in October, according to a Central Bank of Nigeria (CBN) spokesman.

The CBN officially launched the eNaira on 25 October following a pilot scheme rolled out in September, making Nigeria the first African country to introduce a CBDC.

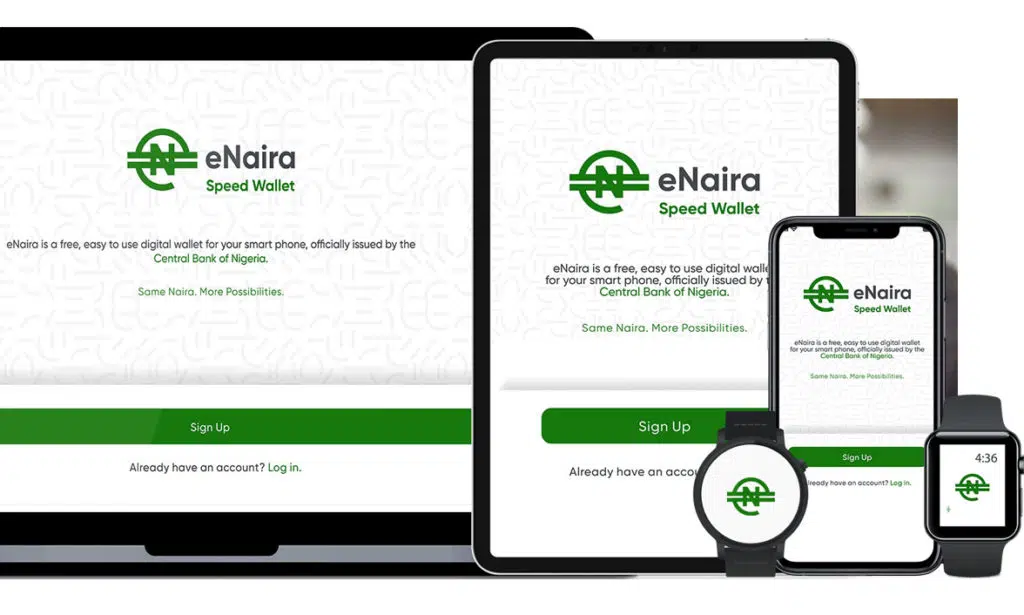

To use the digital currency, consumers first download the eNaira customer wallet and then link it to their bank account or upload cash via a bank or other certified agency.

Digital eNaira customer wallets are available in four tiers with daily transaction limits ranging from 20,000 naira (US$49) to 1m naira (US$2,435) depending on whether a user is banked or unbanked and has “minimal” or “regular spending abilities”.

As well as making contactless in-store payments and peer-to-peer transfers, including international remittances, users can choose to pay their taxes and bills from their eNaira wallet and opt to receive government financial aid in the CBDC.

Merchant support

Some 78,000 merchants from more than 160 countries have already added support for the eNaira, the CBN spokesman told Bloomberg.

“The eNaira […] marks a major step forward in the evolution of money and the CBN is committed to ensuring that the eNaira, like the physical Naira, is accessible by everyone,” the bank says.

“Given that the eNaira is a journey, the unveiling marks the first step in that journey, which will continue with a series of further modifications, capabilities and enhancements to the platforms.

“The CBN will continue to work with relevant partners to ensure a seamless process that will benefit every user, particularly those in the rural areas and the unbanked population.”

Next: Visit the NFCW Expo to find new suppliers and solutions