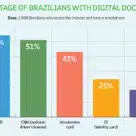

One in two Brazilians now store contactless credentials on their smartphone

More than half of the Brazilian population are now storing and using a digital version of their voter ID card (54%) or driving licence (51%) on their smartphone, while just over four in ten have a digital vaccination card (43%) and one in four have uploaded the recently launched digital Carta de Identidade Nacional national ID card (25%), according to a survey... More