Samsung Pay expands in Canada with new partners — Samsung Electronics Canada — “Following a successful introduction with CIBC in the Canadian market, Samsung remains committed to enhancing Samsung Pay and making it a holistic digital wallet extending beyond credit cards with the introduction of debit cards and new partners including Interac Debit, Scotiabank, American Express Canada, ATB Financial, Visa Canada and Mastercard. In addition, Samsung Pay will be made available soon to Tangerine and Peoples Card Services customers.”

Canada

Survey: Market fragmentation is holding back the adoption of mobile payments in Canada

Fragmentation, lack of interest to blame for poor mobile payments adoption in Canada — MobileSyrup — “While almost half of Canadians made a contactless purchase with their debit or credit card, the percentage of mobile payments users for platforms like Android Pay, Samsung Pay and Apple Pay is in the low single digits — even though awareness is “relatively high,” with roughly half of those polled stating they were aware of one of the big three platforms.”

Canadian bank lets customers use learning AI to transact in Facebook Messenger

ATB Financial rolls out world’s first full-featured virtual banking assistant on Facebook Messenger — ATB Financial — “What makes ATB’s virtual assistant unique? Far beyond a Q&A chatbot, its sophisticated banking transaction abilities offer robust personal financial management tools tailored to fit the needs of each individual customer. Customers can seamlessly pay bills, view account balances, send Interac e-Transfers or transfer money between accounts, as well as perform cross-currency money movement all from within their Messenger platform… The virtual assistant is always learning. The more customers engage with it, the more it will be able to do.”

Mastercard to eliminate signature verification at the point of sale

No more signing on the dotted line — Mastercard — “More than 80% of Mastercard in store transactions in North America today do not require a cardholder signature at checkout… That number could now reach 100% after April 2018, when we will no longer require signatures at checkout for any credit or debit purchases in Canada and the US.”

TD Bank to add AI to mobile banking app

TD announces conversational AI platform agreement with Kasisto — Kasisto — “Through the AI-powered interactive chat interface, TD app users will be able to check account information, review transaction histories and monitor spending levels. In addition, customers will also be able to get instant answers about specific spending-related questions including how much they spent on a recent weekend getaway, what their largest transaction was last week, or what they spent on categories like groceries or coffee last month.”

GlaxoSmithKline puts NFC tags on store shelves

Thinfilm and GlaxoSmithKline bring NFC technology to leading over-the-counter brand Flonase — Thinfilm — “GSK introduced interactive ‘smart’ Flonase shelves in retail stores across Canada in an effort to educate consumers about the new product and guide them in their purchasing decision… The cloud-based platform integrates with the NFC hardware, enabling GSK to manage tags remotely, deliver custom messaging and content, view real-time consumer tapping activity, and develop valuable consumer insights through built-in analytics functionality.”

American Express launches mobile-first credit card in Canada

American Express goes mobile-first with its new millennial-facing credit card — IT Business Canada — “According to AmEx director of new product development Laura Cocksedge, the card was designed start to finish as a mobile-first experience, with users able to use the Cobalt’s accompanying app to register for the card, verify their identities, track their spending, and use it with mobile payment platforms including Apple Pay, Android Pay, and American Express’s own AmEx Pay.”

More than half of consumers in US, Canada and UK expect to abandon cash in next two years

Consumers to abandon cash by 2020 — Paysafe — “In Canada and the UK, contactless has paved the way for this new era of payments, with three out of five consumers regularly using it for purchases, 62% citing it as more convenient than cash, and 44% stating they preferred to shop in places that take contactless… However, it is America that is very much leading the way in new payment methods with nearly a third (31%) using mobile wallets and one in seven using cryptocurrencies.”

Moneris study reveals 36% contactless payment increase in Canada

Moneris study reveals 36% contactless payment increase in Canada — MobileSyrup – “Moneris unveiled a 36.29% year-over-year gain, possibly due to Android Pay recently launching in Canada, and with little more than a year since Apple Pay’s full Canadian release… Within the next five and a half months Moneris predicts that 50% of all Canadian transactions will be contactless.”

TD Canada for iOS now lets you easily add TD cards to Apple Pay

TD Canada for iOS now lets you easily add TD cards to Apple Pay — iPhone in Canada – “TD Canada for iOS has been updated to make it easier to add your TD cards to Apple Pay… This update will assist new Apple Pay users to easily adopt the mobile wallet, as all they have to do is verify their TD cards within the bank’s iOS app, instead of scanning or manually entering numbers within Apple Wallet.”

American Express goes live with Android Pay in Canada

AmEx cardholders in Canada are now able to make mobile payments using Android Pay, American Express has announced... More

Scotiabank adds multi-loyalty programs to mobile banking apps

Customers of Canada’s Scotiabank can now add, access and track their loyalty cards from 18 different programs using the bank’s mobile banking and My Mobile Wallet apps, which have been integrated with “multi-loyalty program functionality” supplied by loyalty network Points... More

ExxonMobil adds credit card issuance to mobile payments app

Motorists using oil and gas company ExxonMobil’s mobile payments app can now apply for the ExxonMobil Smart Card credit card directly through the app... More

Chinese mobile payment apps launch in Vancouver, Toronto

Chinese mobile payment apps launch in Vancouver, Toronto — The Globe and Mail — “OTT Financial Inc is working with Chinese Internet giants Tencent and Alibaba to introduce their mobile-payment infrastructure in Canada. The two apps, WeChat Pay and Alipay, are linked with users’ credit cards and allows them to make payments in renminbi, which is then converted to Canadian dollars before it’s transferred to merchants.”

Rambus to enable Interac debit card support for Android Pay in Canada

PARTNER NEWS: Rambus is working with Google and Canada’s Interac Association to enable support for Interac debit cards on Android Pay following its launch in the country earlier this month... More

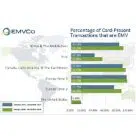

More than half of global card-present payments used EMV standard in 2016

More than half of all card-present transactions conducted globally (52.4%) between January and December 2016 used the EMV chip card standard, up from 35.8% for the same period in 2015, standards body EMVCo has revealed... More

Android Pay goes live in Taiwan with CTBC and First Bank

Android Pay has launched in Taiwan, taking the mobile payment service to a total of 13 markets following its debut in Canada earlier this week... More

Android Pay begins its rollout across Canada

Android Pay has begun rolling out across Canada with support for eligible Visa and Mastercard credit cards from BMO Bank of Montreal, CIBC, Banque Nationale, Scotiabank, Desjardins, President’s Choice Financial, ATB Financial and Canadian Tire Financial Services as well as prepaid Scotiabank and Desjardins cards... More

Public-private sector digital currency experiment releases results of phase II

Public-private sector digital currency experiment releases results of phase II — Payments Canada — “The Bank of Canada, along with Payments Canada, R3 and seven commercial banks, today disclosed the results of phase II of Project Jasper, an experimental wholesale interbank payment system, using digital ledger technology (DLT)… The results show that, despite progress made, underpinning an entire wholesale payments system with DLT still faces many hurdles.”