The total number of contactless card payments made in Spain increased by 10% during 2021, the highest growth rate recorded in Europe, according to payment services provider Minsait Payments... More

- Apple Pay users in the US to get buy now pay later option with iOS 16

- BIS reports on CBDCs in emerging markets

- Moroccan bank launches biometric payment card

- US digital bank introduces contactless payments rings

- Riksbank completes digital currency payments pilot

More than one in three in-person payments in Latin America and the Caribbean are now contactless

More than a third of in-person payments made using Visa credentials across Latin America and the Caribbean in December 2021 were contactless (“close to 35%”), a two-fold increase on the same period in 2020, according to Visa Consulting and Analytics (VCA). More

Dejamobile gets PCI CPoC certification for its software POS solution

PARTNER NEWS: Dejamobile has received PCI CPoC certification for its white label ReadyToTap Payment for Merchants solution, enabling merchants around the world to be provided with the ability to accept contactless payments on standard Android NFC devices... More

BIS finds consumers worldwide are switching to digital and contactless payments at ‘unprecedented rate’

Consumers in key markets around the world have switched from physical cash to digital and contactless payment methods at “a rate unprecedented” since the Bank for International Settlements (BIS) launched its Red Book of payment and settlement statistics in 2004, BIS says. More

IMF reports on digital currencies

Around 100 countries are now exploring the potential development and issuance of a central bank digital currency (CBDC), and the challenges and opportunities identified by these research projects reveal a need for “increased international information-sharing of insights learned”, according to an International Monetary Fund (IMF) report. More

Keep up to date: Get NFCW's headlines by email every Wednesday

EMVCo reveals plans to extend specifications and testing programmes

EMVCo is to launch an initiative to evaluate the role of wireless technologies not yet covered in its specifications — including Wi-Fi, ultra wideband (UWB), Bluetooth Low Energy (BLE) and mobile data — in creating “flexible and convenient payment experiences”, the technical body’s annual report reveals. More

Google Pay adds in-app personal loans in India

Google Pay users in India can now apply for and receive a personal loan in their bank account via the payment service’s app... More

Entrust to offer digital-first payment solutions via Antelop acquisition

PARTNER NEWS: The acquisition of Antelop Solutions by Entrust will enable the development of more comprehensive solutions for the issuance of both digital and physical payment cards and offer customers “true digital-first payment credentials with physical card synergies that fully align with consumer expectations for simplicity and security,” the companies have revealed... More

EU to propose legislative framework for a digital euro in ‘early 2023’

The European Commission is to launch a consultation prior to proposing legislation that will lay out the legal framework for the ongoing development and potential issuance of a digital euro by the European Central Bank (ECB). More

Japanese merchants trial face payments for customers wearing a mask

Consumers using 10 restaurants and retail outlets in the Japanese city of Niigata can now test a biometric payments service that lets them authenticate contactless payments with their face even if they are wearing a mask... More

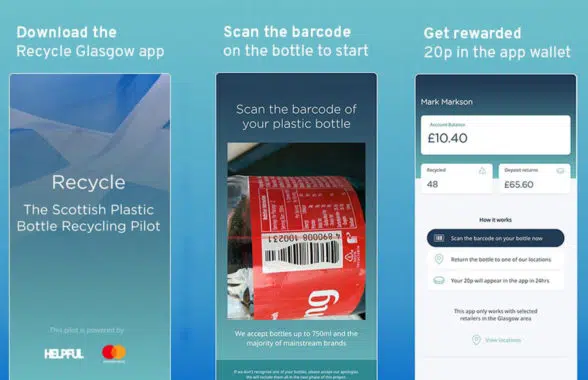

Scotland trials digital micropayments as rewards for recycling plastic

Consumers in Glasgow in Scotland can now take part in a pilot scheme that rewards participants with a micropayment made directly into a digital wallet on their smartphone every time they recycle a single-use plastic bottle... More

Apple to let US merchants accept contactless payments on their iPhone

Merchants in the US will soon be able to accept contactless payments on their iPhone via a “partner-enabled iOS app” without needing to connect their device to a payment terminal or other additional hardware, Apple has announced... More

Keep up to date: Get NFCW's headlines by email every Wednesday

Eight in ten card payments in Nordic countries are now contactless

Eight in ten card payments made in the Nordic countries during 2021 were contactless, an increase from 74% in 2020, according to figures from regional payments processor Nets... More

One in five in-person Visa card transactions in the US are now contactless

Nearly 20% of all in-person Visa card transactions in the US are now contactless, with that proportion rising to more than 25% in Los Angeles, Detroit, Orange County, Miami and Salt Lake City, over 30% in San Francisco, San Jose and Oakland, and reaching 45% in New York, according to the card network’s Q1 2022 earnings call. More

Carnival adds support for on-shore contactless payments to on-board wearable payments device

Passengers on Princess Medallion Class cruise ships can now use their Princess Medallion NFC-enabled wearable device to make contactless payments at on-shore merchants that support leisure travel giant Carnival Corporation’s Medallion Pay payments service... More

CIH Bank picks Dejamobile for NFC mobile payments

PARTNER NEWS: Morocco-based CIH Bank has launched CIH Pay, a mobile payments service that allows customers to digitize their bank card on their smartphone and use it to make in-store contactless payments... More

One in two in-person Mastercard transactions worldwide are now contactless

One in two in-person transactions authorised, cleared and settled through Mastercard’s payment processing services worldwide during Q4 2021 were contactless, up from “approximately” one in three in the period prior to the Covid-19 pandemic, according to figures revealed at the card network’s Q4 earnings call. More

China’s JD.com lets consumers make online payments from digital yuan hard wallets using NFC

Chinese consumers can now make online payments for purchases from the JD.com ecommerce app using digital yuan stored on a physical card or hard wallet via their Android NFC smartphone... More

UK sees 40% rise in contactless transaction values in 2021

The total transaction value of contactless card payments made in UK stores “surged” by 40.2% in 2021 and the average number of contactless payments made each day increased by 27.5% compared with the previous year, according to Barclaycard... More

Apple to let merchants accept contactless payments on iPhones?

Apple may soon enable merchants to accept contactless payments on their iPhone without needing to connect their device to a separate payment terminal or other additional hardware, according to reports. More