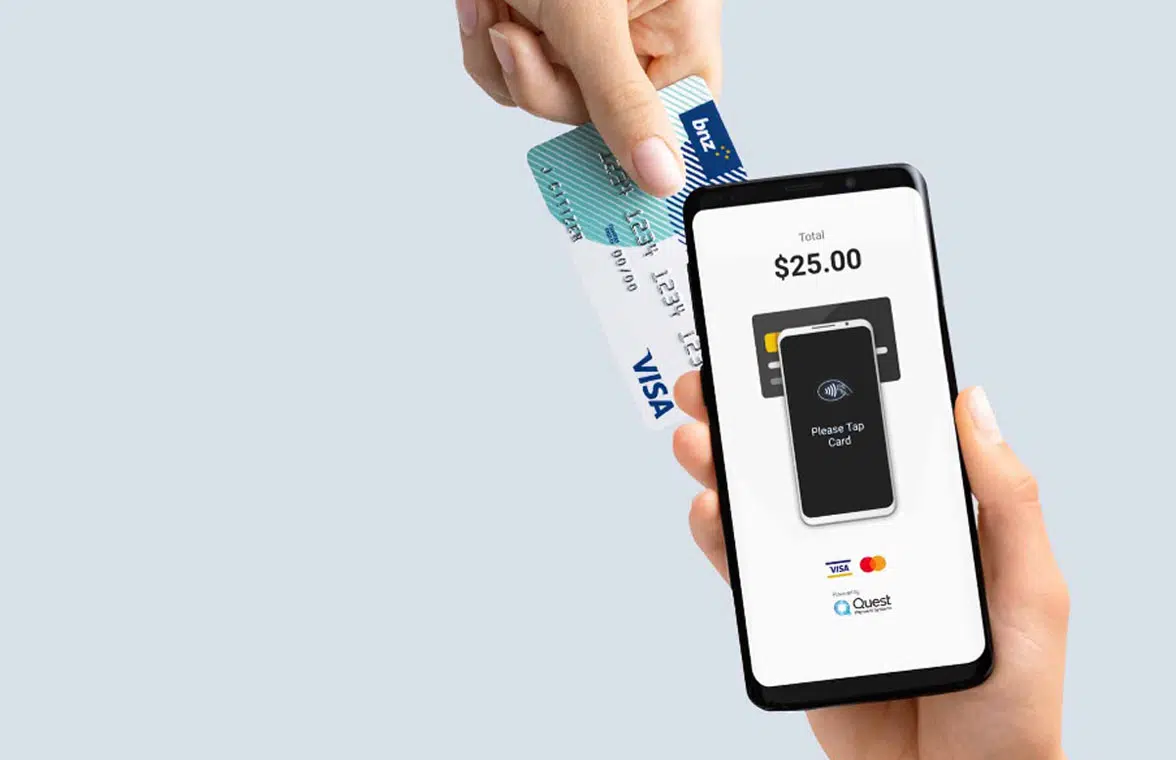

Merchants in New Zealand can now accept contactless payments on an ordinary Android NFC smartphone using a low-cost software point of sale (sPOS) solution that users will be able to implement without a monthly fee for using the app until January 2024 if transactions are settled to a Bank of New Zealand (BNZ) account.

BNZ has launched the BNZ Pay tap-on-phone payments acceptance app as a “safe, secure and easy to use” solution for small- to medium-sized businesses such as weekend market vendors, local cafes, sole traders and taxi drivers” and says that it “will provide the lowest cost solution in the market for enabling contactless card acceptance”.

From 2024, all merchants using the app will be charged the NZ$10 (US$6.40) basic monthly fee levied at launch for those without a BNZ account and the service will calculate a flat-rate monthly transaction fee package for each merchant according to their net monthly sales.

Monthly transaction fees will range from NZ$5 (US$3.20) for merchants with net monthly sales of up to NZ$400 (US$255.20) to NZ$545 (US$347.70) for those with net monthly sales up to NZ$54,000 (US$34,454). Sales over and above the monthly cap will be charged at a flat rate of 1.1%, BNZ says.

BNZ Pay is “an intuitive interface and a dashboard where the business can see all the sales and business info, it can issue invoices, manage customer profiles, and send receipts by text or email,” BNZ’s Karna Luke says.

“We’ve seen a seismic shift in consumer preferences around payments, especially since the beginning of the pandemic. In branches, cash use is way down, and according to RBNZ’s report only 70% of Kiwis now use cash at all.

“That’s a big decrease from 2019 when the survey found 96% still used cash. Businesses need to be prepared and able to take payments from their customers in the ways they want to pay them.”

Next: Visit the NFCW Expo to find new suppliers and solutions