US law firm Hagens Berman has filed a class action lawsuit against Apple alleging that, by preventing mobile wallets other than Apple Pay using the NFC chip in iPhone and Apple Watch to enable contactless payments, the company is in breach of federal antitrust law.

The lawsuit also claims that by having “unlawfully linked two of its products — mobile devices and its proprietary wallet”, Apple “unlawfully monopolises for tap-and-pay mobile wallets on iOS” and that consequently the reported US$1bn Apple collects annually in fees from card issuers is also in violation of federal antitrust law.

Hagens Berman — which has previously filed two antitrust lawsuits involving Apple, one for US$560m in 2015 and another for US$100m this year — lists Iowa’s Affinity Credit Union as the plaintiff, but says that the lawsuit “seeks to represent a class of US credit unions and financial institutions that issue payment cards enabled for use in Apple Pay”.

“The class action was filed in the US District Court for the Northern District of California and accuses Apple of denying rivals access to the technology needed to develop a competing mobile wallet,” the law firm explains.

“On iOS devices, Apple has ensured that only its mobile wallet, Apple Pay, can make contactless payments at the point of sale. Having secured a monopoly for Apple Pay in this fashion, Apple charges card issuers who use Apple Pay supracompetitive fees for a service that is available on Android devices for free, according to the lawsuit.”

“The lawsuit seeks to reimburse payment card issuers who have been charged Apple Pay’s fees and seeks injunctive relief to put an end to Apple’s policies,” the firm adds.

Proprietary service

More specifically, the complaint filed by the law firm alleges that “in contrast to the Android ecosystem, there is only one tap and pay mobile wallet that can be used on Apple’s iOS devices (iPhone, iPad and Apple Watch). The only option is Apple Pay, Apple’s own proprietary service.

“Apple did not secure pre-eminence for Apple Pay by building a better product. Apple Pay is mostly indistinguishable from Google Pay and Samsung Pay from a functionality standpoint. Rather, Apple propped up Apple Pay by requiring iOS users to use its Apple Pay service exclusively for tap and pay mobile wallet transactions, barring all would-be and free competitors from accessing the NFC interface needed to compete.

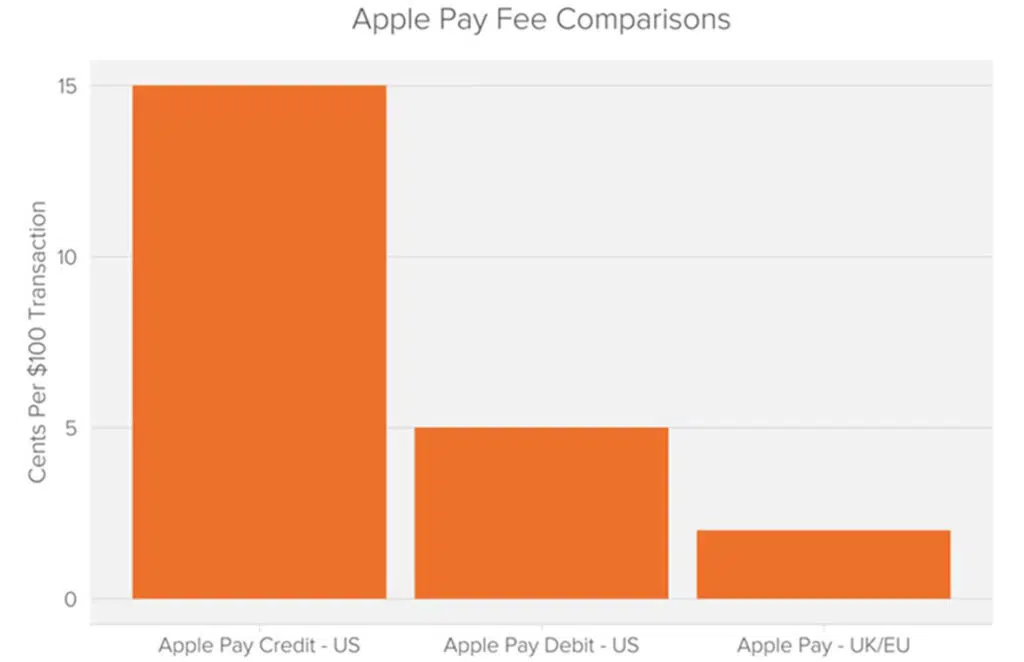

“Having barred all competitors from its devices, Apple charges payment card issuers fees that no other mobile wallet ventures to impose. Whenever an Apple Pay transaction is completed on a US issuer’s payment card, the issuer must pay Apple a fee — 15 basis points on credit and a flat 0.5 cents on debit. These fees generated a reported $1bn for Apple in 2019, and this revenue stream — earned from card issuers — is predicted to quadruple by 2023.

“Apple’s issuer fees are manifestly supracompetitive and the result of the anticompetitive conduct alleged herein. In the Android ecosystem, where multiple digital wallets compete, there are no issuer fees whatsoever.

“The upshot is that card issuers — the proposed class here — pay a reported $1bn annually in fees on Apple Pay and $0 for accessing functionally-identical Android wallets. If Apple faced competition, it could not sustain these substantial fees.

“Alternative mobile wallets, including Google Pay, would be downloaded onto iOS devices, and card issuers would agree to make their cards available on those substitute mobile wallets at zero cost and would not agree to make their cards available on Apple Pay unless and until Apple reduced its price to the competitive level.”

The lawsuit comes as the European Parliament has adopted the Digital Market Act that will obligate Apple, Google and other “gateway” technology companies to allow app developers and third-party service provides access to device functionalities including NFC technology.

Next: Visit the NFCW Expo to find new suppliers and solutions